According to a recent Mercer report, the landscape of pension fund management could be significantly transformed through Artificial Intelligence (AI). By leveraging AI, pension funds might substantially lower operational costs, boost investment returns, and better identify potential risks. The Mercer CFA Institute global pension report released on October 17, underscores the capacity of AI in sifting through vast data arrays, enabling fund managers to pinpoint investment opportunities and tailor investment portfolios accordingly.

The report’s lead author, David Knox, emphasizes that AI’s integration could enhance both the member experience and retirement outcomes globally. Through AI-powered natural language tools, pension funds can delve into member interactions, allowing for personalized marketing strategies. Moreover, AI’s analytical prowess can unearth market trends, suggesting unorthodox investment avenues which might lead to improved asset diversification and potentially higher long-term returns.

Furthermore, AI can play a pivotal role in managing environmental, social, and governance (ESG) factors, besides automating core operational processes, which could bridge the gap between passive and active investment strategies by reducing costs. Predicting member behavior under varying economic and political scenarios is another advantage, aiding in better cash flow management for the funds.

However, the journey towards AI integration isn’t without hurdles. The technology may sometimes churn out false or misleading information. Moreover, despite its predictive analytics, AI might fall short in accurately forecasting market prices, thus a degree of uncertainty remains. This calls for strong cybersecurity measures to safeguard against potential external threats.

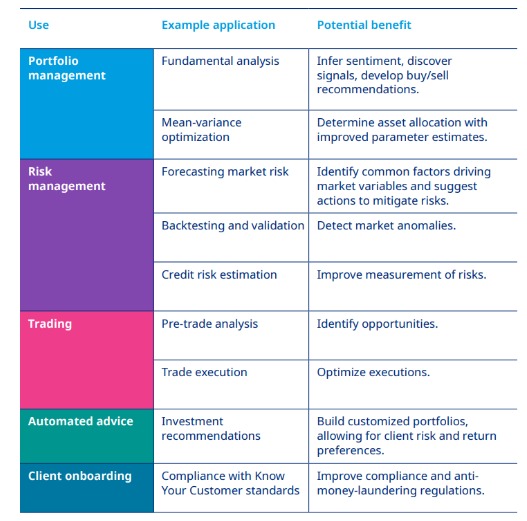

The report also touches upon the existing use of AI in investment markets through algorithmic trading, which has been evolving since the 1980s. It underscores the significant contribution of algorithmic trading to automated trading, marking up to 73% of US equity trading in 2018 alone, showcasing the substantial impact AI has already made in the financial domain.