In the dynamic world of personal finance, choosing the right budgeting tool can make a significant difference. The debate between “PocketSmith vs YNAB” has been a topic of interest for many seeking the perfect solution for their financial management needs. Both PocketSmith and YNAB stand out as top-tier budgeting apps, each boasting its unique methodology to guide users in their financial endeavors. Budgeting not only helps in prudent allocation of resources but also sets the foundation for forecasting future financial situations. This article will take a deep dive into the distinct features, benefits, and contrasts of PocketSmith and YNAB, aiming to offer clarity to those in pursuit of the ideal budgeting platform.

Ease of Use

In the world of budgeting apps, user experience and interface play a pivotal role in determining the success and adoption rate of the platform. Both PocketSmith and YNAB have carved a niche for themselves in this domain, but how do they fare when it comes to ease of use?

PocketSmith User Experience

PocketSmith offers a comprehensive suite of tools to help users manage their finances. The platform’s interface is designed to provide a holistic view of one’s financial situation. However, for those who are new to budgeting apps, the plethora of features might seem overwhelming at first. The free version of PocketSmith, while feature-rich, has its limitations. For instance, users can only track two accounts, and there’s no automatic transaction import, which means manual entry for every transaction. This can be time-consuming and might deter users who are looking for a more automated experience.

YNAB User Experience

YNAB, on the other hand, adopts a more streamlined approach. It emphasizes the principle of “giving every dollar a job,” which means users need to allocate where every dollar in their bank balance will go and set goals. This zero-based budgeting approach might require some getting used to, especially for those new to the concept. YNAB offers a free 34-day trial, allowing users to familiarize themselves with the platform before committing to a subscription. The platform is accessible via various devices, including browsers, iPhones, iPads, Android devices, and even Amazon Alexa, making it versatile and user-friendly.

Learning Curves and Challenges

For new users, both platforms come with their set of challenges. PocketSmith’s vast array of features might seem daunting initially, and the manual transaction entry in the free version can be a deterrent. YNAB’s zero-based budgeting approach, while effective, might require a mindset shift for those accustomed to traditional budgeting methods.

When comparing the ease of use between PocketSmith and YNAB, it boils down to individual preferences and needs. Those looking for a detailed financial overview might lean towards PocketSmith, while those seeking a more straightforward and goal-oriented approach might find YNAB more suitable. Regardless of the choice, it’s essential to invest time in understanding the platform to make the most of its features and achieve one’s financial goals.

Free Features

Budgeting apps often provide free versions to allow users to test their platforms and decide if they’re a good fit for their financial needs. Both PocketSmith and YNAB offer free options, but they come with their own set of features and limitations. Let’s delve into the details:

PocketSmith’s Free Features

PocketSmith’s free version is designed for those who are hesitant about investing in a budgeting app right away. The platform provides users with essential features such as:

- Tracking expenses by category.

- Creating custom budget categories.

- Offering financial forecasts.

However, the free version of PocketSmith does come with its limitations:

- Number of Accounts: Users can only track two accounts. This might be restrictive for individuals with multiple bank or credit card accounts.

- Transaction Imports: One of the most significant limitations is the absence of automatic transaction imports. This means users have to manually enter every transaction, which can be tedious and time-consuming.

YNAB’s Free Features

Unlike PocketSmith, YNAB doesn’t have a permanent free version. Instead, they offer:

- 34-Day Free Trial: This trial period allows new users to explore all the features of YNAB’s premium plan for a month (plus a few extra days). It’s a comprehensive way to understand the platform’s capabilities before deciding on a subscription.

Limitations of YNAB’s Free Trial

- Duration: The most apparent limitation is the trial’s duration. After 34 days, users have to decide whether to subscribe or discontinue using the platform.

- No Ongoing Free Plan: Once the trial period ends, users can’t continue using YNAB for free, unlike PocketSmith which has a continuous free version, albeit with limitations.

In conclusion, when comparing the free features of PocketSmith and YNAB, potential users need to consider their personal financial tracking needs. PocketSmith offers a continuous free version but with limited features, while YNAB provides a comprehensive trial period but requires a subscription afterward. Making an informed choice will ensure that users get the most out of their chosen platform without any unexpected surprises.

Paid Features

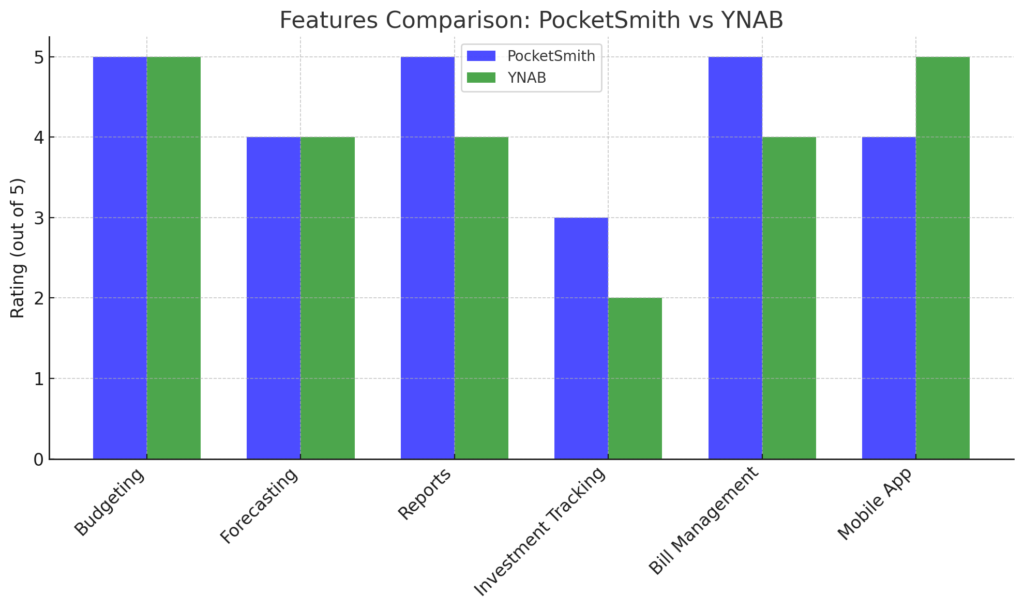

When it comes to managing finances, premium features in budgeting apps can make a significant difference. Both PocketSmith and YNAB offer paid versions that come with enhanced functionalities. Let’s dive into the details:

PocketSmith Premium Features

- Account Tracking: PocketSmith’s premium plans allow users to track a varying number of accounts. The lower-tier plan supports up to 12 accounts, while the highest-tier plan offers unlimited account tracking.

- Automatic Transaction Imports: Unlike the free version, the paid versions of PocketSmith automatically import transactions from connected financial accounts, streamlining the tracking process.

- Diverse Account Types: PocketSmith supports a wide range of account types, including checking, savings, retirement accounts, credit card accounts, loans, and investments. This comprehensive tracking ensures users have a complete picture of their financial health.

- Financial Forecasting: PocketSmith stands out with its ability to forecast future finances, helping users plan ahead and make informed decisions.

- Platform Accessibility: Users can access PocketSmith from various devices, including desktop apps for Windows, Mac, and Linux, as well as mobile apps for iOS and Android.

YNAB Premium Features

- Purposeful Budgeting: YNAB emphasizes the principle of “giving every dollar a job.” Users allocate every dollar in their bank balance to specific categories and set financial goals.

- Detailed Reports: YNAB offers reports in three categories: “spending,” “net worth,” and “income vs. expense.” These reports are invaluable for financial forecasting and understanding spending habits.

- Credit Card Payment Tracking: YNAB aids users in tracking credit card payments, which can help improve credit scores.

- Routine Bills and Income Tracking: YNAB is effective for tracking regular bills and income, ensuring users stay on top of their monthly financial obligations.

- Platform Versatility: YNAB is accessible via browsers and supports a wide range of devices, including iPhones, iPads, Apple Watches, Android devices, and even Amazon Alexa.

- Limitation: It’s worth noting that YNAB does not support investment account tracking, which might be a drawback for some users.

In conclusion, both PocketSmith and YNAB offer robust premium features tailored to cater to different financial needs. While PocketSmith provides a more comprehensive view of one’s finances, including investments, YNAB focuses on a more structured budgeting approach. Users should choose based on their specific requirements and the aspects of financial management they prioritize.

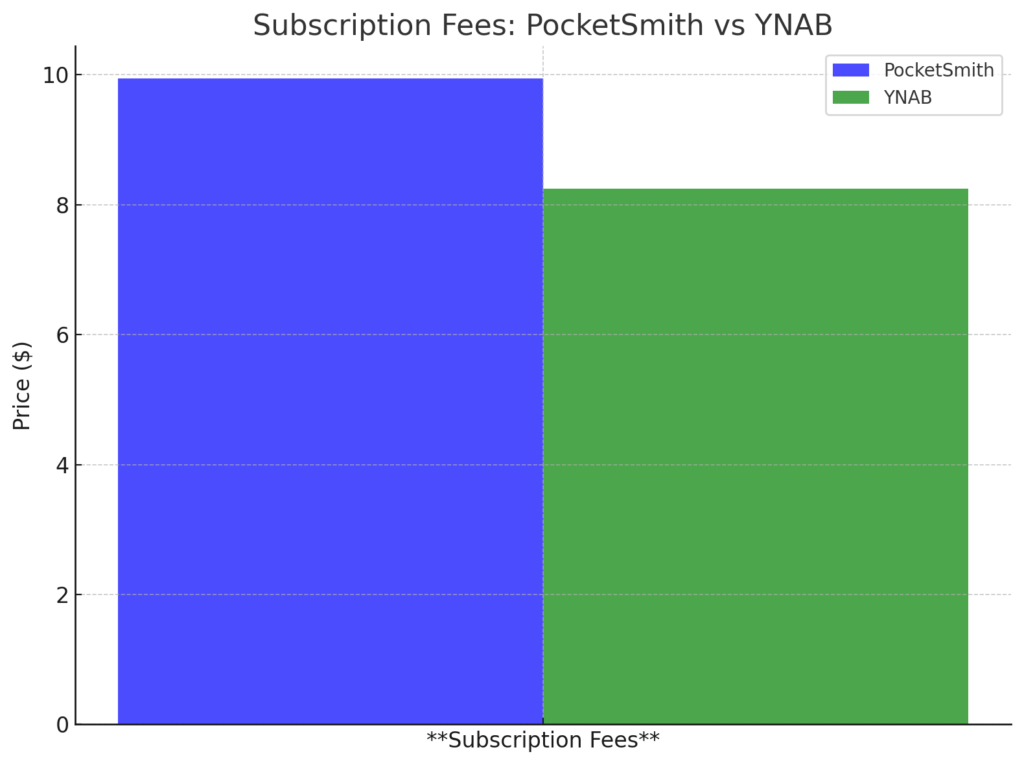

Subscription Costs: PocketSmith vs YNAB

Choosing the right budgeting app often boils down to the value it offers for its price. Both PocketSmith and YNAB come with subscription costs, each providing a unique set of features. Let’s break down the pricing plans of both apps and evaluate their value proposition.

Table:

| Feature/Aspect | PocketSmith | YNAB |

| Subscription Fees | $9.95 – $19.95/month | $8.25 – $14.99/month |

| Billing Options | Monthly or Annually | Monthly or Annually |

| Supported Platforms | Mac, Windows, Linux, iOS, Android | iOS, Android, Web |

| Best Use | Budgeting, tracking, and financial forecasting | Budgeting, tracking, and financial forecasting |

PocketSmith Subscription Costs

- Premium Plan: Priced at $9.95 per month, users can avail a discounted rate of $7.50 per month if they opt for an annual subscription.

- Super Plan: This plan comes at $19.95 per month, but the cost can be reduced to $14.16 per month with an annual subscription. This plan is recommended for those who wish to track more than 12 accounts concurrently.

YNAB Subscription Costs

– YNAB offers a single plan with two billing options. The monthly subscription is priced at $14.95, while the annual subscription offers a discounted rate of $8.25 per month, totaling $99 for the year.

Value for Money

- PocketSmith: While PocketSmith offers a comprehensive set of features, especially for those with diverse financial accounts, its pricing is on the higher side. However, for users who require detailed financial tracking and forecasting, especially involving investment accounts, the cost might be justified.

- YNAB: YNAB’s pricing is more straightforward and slightly more affordable. Its unique approach to budgeting, “giving every dollar a job,” combined with its detailed reporting, offers substantial value, especially for those new to budgeting or those who prefer a structured budgeting methodology.

In conclusion, the choice between PocketSmith and YNAB largely depends on individual financial needs and the depth of features required. Both platforms offer robust tools for financial management, but potential subscribers should weigh the features against the costs to determine which platform offers the best value for their specific requirements.

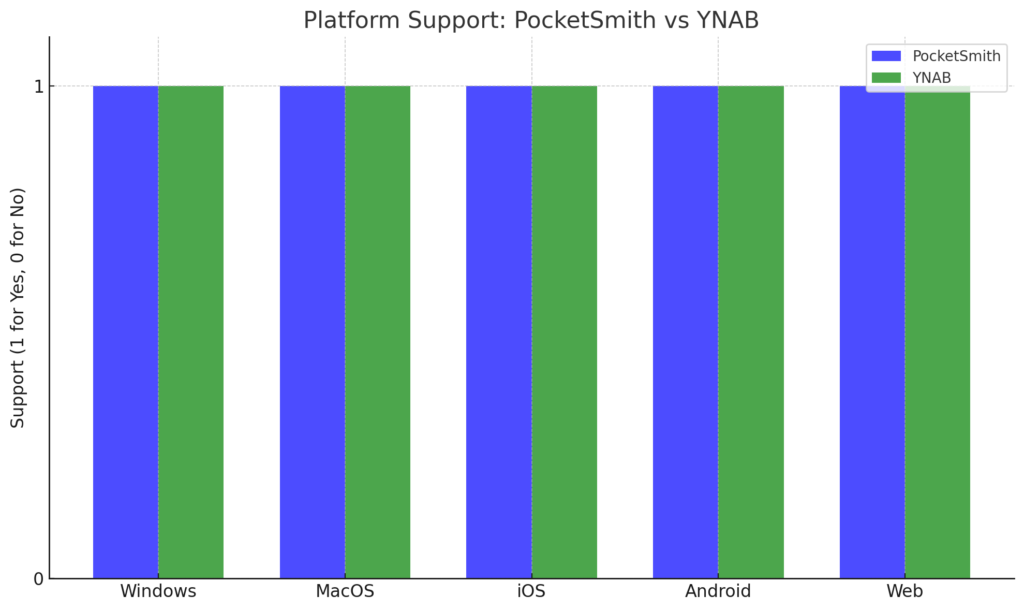

Platform Support

The accessibility of a budgeting app across various devices and operating systems is crucial for users who want to manage their finances on the go. Both PocketSmith and YNAB offer support across multiple platforms, ensuring users can access their financial data wherever they are. Here’s a breakdown of the devices and operating systems supported by each platform:

Table:

| Platform/Device | PocketSmith | YNAB |

| Desktop | Mac, Windows, Linux | Web (Browser-based) |

| Mobile | iOS, Android | iOS, Android |

| Web | Yes | Yes |

| Other | – | Amazon Alexa (via integration) |

PocketSmith Platform Support

- Desktop: PocketSmith offers desktop applications for Mac, Windows, and Linux, allowing users to manage their finances directly from their computers.

- Mobile: PocketSmith has mobile apps available for both iOS and Android devices, ensuring users can track their finances on the go.

- Web: PocketSmith is also accessible via web browsers, providing flexibility for users who prefer online access.

YNAB Platform Support

- Desktop: YNAB is primarily web-based, meaning users can access their accounts directly from any browser without needing to download a separate application.

- Mobile: YNAB offers mobile apps for both iOS and Android devices, making it easy for users to manage their budget and track expenses while on the move.

- Other: An interesting feature of YNAB is its integration with Amazon Alexa, allowing users to access their budget and other financial data via voice commands.

In conclusion, both PocketSmith and YNAB offer comprehensive platform support, catering to a wide range of user preferences. Whether you’re a desktop enthusiast, a mobile user, or someone who prefers accessing their financial data online, both platforms have got you covered.

Financial Forecasting: PocketSmith vs YNAB

Financial forecasting is a crucial feature in budgeting apps, allowing users to predict their future financial situation and make informed decisions. Both PocketSmith and YNAB offer financial forecasting capabilities, but they approach it differently. Let’s delve into the details:

Table:

| Feature/Aspect | PocketSmith | YNAB |

| Forecasting Method | Detailed financial forecasting based on current data | Zero-based budgeting with goal setting |

| Account Types Supported | Checking, savings, retirement, credit cards, loans, investments | Primarily bank and credit card accounts |

| Future Transactions | Predicting future transactions | Allocating every dollar for specific purposes |

| Platform Accessibility | Desktop (Mac, Windows, Linux), Mobile (iOS, Android), Web | Web, Mobile (iOS, Android), Amazon Alexa integration |

PocketSmith Financial Forecasting

- Detailed Forecasting: PocketSmith provides users with a comprehensive financial forecast based on their current financial data. This includes predictions for future transactions, allowing users to see potential financial outcomes.

- Account Types: PocketSmith supports a wide range of account types, including checking, savings, retirement accounts, credit card accounts, loans, and investments. This ensures users have a holistic view of their financial future.

- Platform Accessibility: PocketSmith can be accessed from desktop apps (Windows, Mac, Linux) and mobile apps (iOS, Android), as well as through web browsers.

YNAB Financial Forecasting

- Zero-Based Budgeting: YNAB’s approach to forecasting is rooted in its zero-based budgeting methodology. Users allocate every dollar in their bank balance to specific categories and set financial goals, ensuring they “give every dollar a job.”

- Account Types: YNAB primarily focuses on bank and credit card accounts. While it offers detailed tracking and goal setting for these accounts, it doesn’t support investment account tracking.

- Platform Versatility: YNAB is accessible via web browsers and supports a wide range of devices, including iPhones, iPads, Android devices, and even integrates with Amazon Alexa for voice commands.

In conclusion, while both PocketSmith and YNAB offer robust financial forecasting tools, their methodologies differ. PocketSmith provides a more detailed and comprehensive view of one’s financial future, especially for those with diverse financial accounts. In contrast, YNAB offers a structured approach to budgeting and forecasting, ensuring users allocate funds purposefully. The choice between the two will depend on individual preferences and the depth of financial forecasting required.

Customization and Flexibility: PocketSmith vs YNAB

Customization and flexibility are essential features in budgeting apps, allowing users to tailor the platform to their specific financial needs. Both PocketSmith and YNAB offer a degree of customization, but they have distinct approaches. Here’s a detailed comparison:

Table:

| Feature/Aspect | PocketSmith | YNAB |

| Custom Categories | Yes | Yes |

| Custom Rules | Yes | Limited |

| Unique Features | Financial forecasting up to 30 years, multiple currencies support | Zero-based budgeting, “Every Dollar Has a Job” philosophy |

PocketSmith Customization and Flexibility

- Custom Categories: PocketSmith allows users to create custom categories, ensuring they can track expenses and income in a way that aligns with their personal financial structure.

- Custom Rules: PocketSmith offers the ability to set custom rules for categorizing transactions, providing users with a more automated and personalized experience.

- Unique Features: One of PocketSmith’s standout features is its ability to forecast finances up to 30 years into the future. Additionally, it supports multiple currencies and international bank accounts, catering to users with diverse financial situations.

YNAB Customization and Flexibility

- Custom Categories: Like PocketSmith, YNAB also allows users to create custom categories, ensuring they can allocate every dollar purposefully.

- Custom Rules: YNAB’s approach to rules is more structured, focusing on its “Every Dollar Has a Job” philosophy. While this provides a clear framework for budgeting, it might be less flexible for users who want more customization.

- Unique Features: YNAB’s zero-based budgeting approach sets it apart. It ensures users allocate every dollar in their bank balance to specific categories, promoting a more disciplined approach to budgeting.

In conclusion, both PocketSmith and YNAB offer customization and flexibility, but they cater to different user preferences. PocketSmith provides a more detailed and comprehensive view with added flexibility, especially for those with diverse financial accounts or international financial needs. In contrast, YNAB offers a structured approach to budgeting, ensuring users allocate funds purposefully and consistently. The choice between the two will depend on individual preferences and the level of customization and flexibility required.

Investment Tracking: PocketSmith vs YNAB

Investment tracking is a pivotal feature for many individuals who want to keep an eye on their growing assets. Both PocketSmith and YNAB cater to users’ financial tracking needs, but their capabilities in investment tracking differ. Here’s a detailed comparison:

Table:

| Feature/Aspect | PocketSmith | YNAB |

| Investment Tracking | Yes | No |

| Supported Investment Types | Stocks, Bonds, Mutual Funds, Retirement Accounts | – |

| Integration with Brokerages | Yes | – |

| Performance Analysis | Yes | – |

PocketSmith Investment Tracking

- Comprehensive Tracking: PocketSmith provides users with the ability to track various types of investments, including stocks, bonds, mutual funds, and retirement accounts.

- Brokerage Integration: One of the standout features of PocketSmith is its ability to integrate with various brokerages, allowing users to automatically import their investment data.

- Performance Analysis: PocketSmith offers tools to analyze the performance of investments over time, helping users make informed decisions about their portfolio.

YNAB Investment Tracking

- Lack of Investment Features: YNAB primarily focuses on budgeting and does not offer dedicated investment tracking features. This means users looking to track their investments would need to rely on another platform or manually input their investment data into YNAB.

- Focus on Budgeting: YNAB’s primary strength lies in its budgeting capabilities, and while it excels in helping users allocate every dollar, it does not delve into the realm of investment tracking.

In conclusion, for users who prioritize investment tracking, PocketSmith offers a more comprehensive solution with its detailed investment tracking features. On the other hand, YNAB, while being a powerful budgeting tool, does not cater to the investment tracking needs of its users. Those looking for a holistic financial management solution might consider using both platforms in tandem or seeking an alternative that combines the strengths of both.

Conclusion: PocketSmith or YNAB

Throughout this article, we’ve delved deep into the features and capabilities of both PocketSmith and YNAB. Here’s a summary of the key points:

- Ease of Use: Both platforms offer intuitive interfaces, but they cater to different user experiences. While PocketSmith provides a more detailed financial overview, YNAB focuses on a straightforward budgeting approach.

- Features: PocketSmith shines in its financial forecasting, supporting up to 30 years into the future, and its ability to track diverse financial accounts, including investments. YNAB, on the other hand, emphasizes its “Every Dollar Has a Job” philosophy, promoting disciplined budgeting.

- Cost: Both platforms come with subscription costs. PocketSmith offers a tiered pricing model, while YNAB has a more straightforward pricing structure.

- Platform Support: PocketSmith provides desktop applications for various operating systems and mobile apps, while YNAB is primarily web-based with mobile app support.

- Customization & Flexibility: PocketSmith offers more flexibility with custom rules and categories, whereas YNAB provides a structured budgeting approach.

- Investment Tracking: PocketSmith stands out with its comprehensive investment tracking features, while YNAB lacks dedicated investment tracking capabilities.

Recommendations for PocketSmith vs YNAB

- For Investment Tracking: Users with investment accounts or those looking for detailed financial forecasting might prefer PocketSmith due to its comprehensive investment tracking features and long-term financial forecasting.

- For Straightforward Budgeting: Those looking for a simple, structured budgeting tool that emphasizes allocating every dollar might lean towards YNAB.

In the end, the choice between PocketSmith and YNAB will largely depend on individual financial needs and preferences. Both platforms offer robust tools for financial management, but they cater to different aspects of financial planning. It’s essential to assess your financial goals and choose the platform that aligns best with your requirements.